Basic Tax Rates:

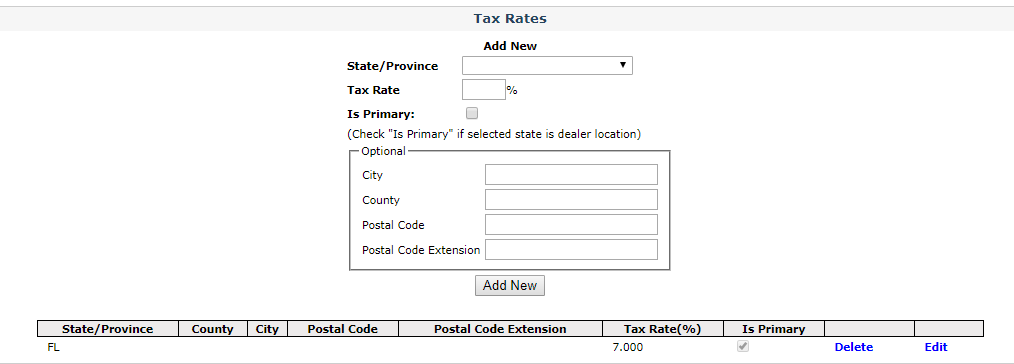

When you enroll with SimplePart, your tax rate will initially be set based on the location of your dealership. This rate will be marked as your “primary” tax rate. However, if you want to change this tax rate or add additional state tax rates, you can do so in the Control Panel.

Your Tax Rate screen is located under the Settings dropdown menu. When you view this screen for the first time, you should see a single row populated with your state or local sales tax rate. If you need to change this tax rate for any reason, click the “Edit” button, make your changes, then click “Update” to update the info on your site in real time. If you need to delete a row, just click the “Delete” button.

Note: It’s important to discuss tax rates with your business office in case you need to collect taxes for multiple states.

Using TaxJar:

SimplePart recently integrated with TaxJar, meaning our dealers get the peace of mind that sales tax is calculated accurately for every order. Dealers on the SimplePart platform have access to more than 10,000 local and state level tax rates, updated monthly.

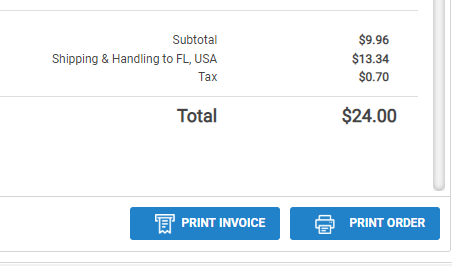

With TaxJar, customers will see the exact amount of local and state level taxes they’ll have to pay based on their shipping address. This will be calculated based on new and changing tax legislation including origin/destination-based tax laws, economic nexus, and shipping.

To review the exact amount of local and state level taxes charged per order, check out the Recent Orders Screen in Control Panel.